Bitcoin. The magical internet money is often derided as “worthless” and “made up” by those who forget that all currencies only have value because we believe in them. Perhaps the world’s strongest currency not backed up by guns and ammo, Bitcoin nonetheless remains a controversial invention, as do the many cryptocurrencies that followed in its wake.

Recently, the Chinese government has cracked down on operations within the country. With China hosting the world’s largest fraction of Bitcoin mining capability, it’s sent shockwaves through the network and had a huge effect in a multitude of ways. Here’s what’s going down.

Chinese officials instructed miners in the Sichuan region and elsewhere to shut down, while also ordering local authorities to cut off power supplies to mining operations. Banks have also been instructed to close accounts or otherwise halt transactions suspected to be related to cryptocurrency operations. With the ability to strike out and make decisions in a way not typically possible in most democracies, the move has been swift and decisive.

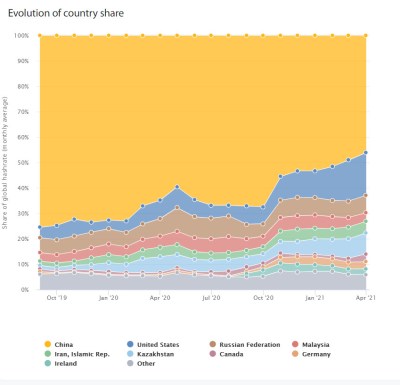

Whispers of the political winds changing around Bitcoin had slowed investment in additional capacity for Chinese miners for some time. Prior to the move, Chinese mining operations accounted for anywhere from 60-75.5% of the global Bitcoin hashrate. According to the Cambridge Bitcoin Energy Consumption Index (CBECI), however, the number quickly sunk down to just 46%.

With many huge mining operations going offline, the power consumption of the Bitcoin network has dropped significantly. Earlier this year, there was much ado made around the fact that Bitcoin was now using more energy than the state of Argentina. We crunched the numbers and found it to be a sound analysis, and a particularly concerning one from an environmental perspective. At the time, Bitcoin was using roughly 15 GW around the clock, for an estimated annual consumption of around 129 TWh over a full year. However, as it stands at the time of writing, CBECI now measures Bitcoin as using just 11.92 GW for an estimated annual consumption of 87.3 TWh which has rebounded from a low near 10 GW earlier this month.

It’s a huge drop, and indicative of just how much mining capacity has gone offline. That has flow-on effects for the operation of the Bitcoin network, too. With less miners hashing, it takes miners longer to find solutions to solve Bitcoin blocks. The difficulty of mining is automatically changed by the Bitcoin algorithm every 2,016 blocks, based on current hashrates, in order to maintain a block solving time of approximately 10 minutes. In normal conditions this happens roughly every two weeks. However, with the huge sudden drop from the loss of Chinese miners, block solving times blew out to 14-19 minutes long until the algorithm ran a correction on July 3. Mining difficulty became 28% easier, a historically large drop for the cryptocurrency.

It’s good news for current miners, who will be sharing the spoils of their efforts with a significantly smaller pool of participants. That should last at least until Chinese operations get up and running in other jurisdictions (which may help explain the August uptick). You’ve probably never been to Kazakhstan, as the country does not prioritize tourism and thus has a poor infrastructure to enable it. However, it’s next door to China and has cheap electricity, so has seen many miners moving their operations there. The United States is also a popular choice for its lack of any organized political opposition to Bitcoin, cheap power, and ease of doing business.

The drop in energy use from 15 GW down to 10 GW was significant, marking a 33% drop. At its lowest recent point, instantaneous consumption had dropped even lower, to roughly 50% of the peak figure. If we take the current number though, we can run some calculations on the effect on emissions. The US Energy Information Administration quotes a figure of roughly 0.92 lbs of CO2 emissions per kWh of energy generated in the USA in 2019. Using that as a ballpark figure, China’s move eliminated 18 million metric tons of CO2 emissions in just a few short weeks. That’s roughly equivalent to taking 3.9 million cars off the road, according to an EPA calculator.

Obviously, switching off Bitcoin altogether would make a huge environmental saving. It would also be theoretically far easier than other efforts such as installing renewable energy sources, switching to cleaner transport, or reducing pollution from major industries. Arguments that mining operations could run on renewable energy ignore the fact that the very energy used to power their mining operations is energy that can’t be used by other users.

Of course, outside of China, it’s not as simple as the government sending a stern letter, and so it’s likely Bitcoin will continue to pollute significantly well into the future. Established, high-wealth players will fight tooth and nail against any force that could harm their investments, after all. Perhaps the biggest danger to the value and profile of Bitcoin, however, is the mere suggestion of government regulation or outright bans. Prices have dropped on the order of 30% from this year’s earlier all time highs, but have recovered strongly as hashrates climb back up and mining operations restablish themselves abroad. We suspect that Bitcoin will achieve much greater heights-and notoriety- before all is said and done.

0 Commentaires